Your cart is currently empty!

Are you dreaming of a life where you can work from anywhere in the world? The digital nomad lifestyle is becoming increasingly popular, offering freedom, flexibility, and adventure. But before you pack your bags and hit the road, there are some crucial steps you need to take. This guide will walk you through 7 essential steps to prepare for your digital nomad journey.

Our recommendations may contain affiliate links, for more information please read the disclaimer.

1. Optimize Your Employment Arrangement

Your work situation is crucial to your success as a digital nomad. There are several paths you can take, each with its own considerations:

a) Negotiate a remote work agreement with your current employer

- Schedule a meeting with your manager to discuss the possibility of working remotely full-time.

- Prepare a detailed proposal outlining how you’ll maintain productivity and communication while working remotely.

- Address potential concerns such as time zone differences, internet connectivity, and data security.

- Suggest a trial period to demonstrate the viability of the arrangement.

- Be prepared to compromise, such as agreeing to periodic in-office visits or specific work hours that overlap with the team’s schedule.

b) Freelancing or running your own business

- If you’re already a freelancer or business owner, you’re well-positioned for the digital nomad lifestyle.

- Consider establishing a Legal Entity in the U.S.:

- Set up an LLC or corporation, preferably in a no-income-tax state.

- This can offer tax benefits and liability protection.

- Research the best state for your business structure based on tax laws and regulations.

- Develop a stable client base before departing to ensure a steady income stream.

- Create systems for managing projects, communicating with clients, and handling finances remotely.

- Consider using platforms like Upwork or Fiverr to find international clients.

c) Transition to consulting

- Leverage your expertise to offer consulting services in your field.

- Develop a clear value proposition and identify your target market.

- Build a professional website showcasing your skills and experience.

- Network extensively, both online and offline, to build your client base.

- Consider partnering with consulting firms that offer remote work opportunities.

d) Seek employment with remote-friendly companies

- Research companies known for their remote work policies.

- Tailor your resume and cover letter to highlight skills valuable for remote work, such as self-motivation and strong communication.

- Be prepared to discuss how you’ll handle the challenges of remote work during interviews.

e) Discuss payroll considerations

- For employed positions, ensure your employer understands the tax implications of your new arrangement.

- Discuss how your salary will be paid – will it be in your home country’s currency or the local currency of where you’re residing?

- Understand how benefits like health insurance and retirement plans will be affected.

Remember, whichever path you choose, it’s crucial to have a stable income source before embarking on your digital nomad journey. Consider having savings to cover at least 3-6 months of expenses as a safety net.

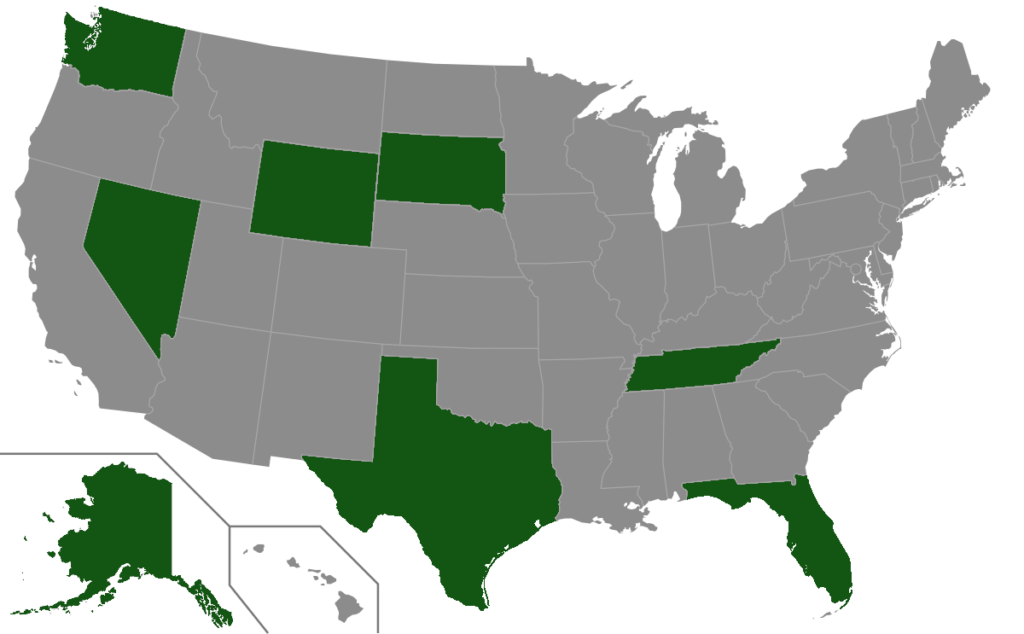

2. Establish Residency in a No-Income-Tax State

One of the key steps in preparing for your digital nomad lifestyle is to establish residency in a tax-friendly state. This can significantly reduce your tax burden while you’re traveling abroad. Here’s a breakdown of the states with no income tax and their residency requirements:

Residency Requirements for States with no income tax:

To establish residency, you typically need to obtain a driver’s license and register to vote. Here are the specific requirements for each state:

Alaska

- Driver’s License: Apply within 90 days of establishing residency.

- Voting: Be a resident for 30 days before the election.

Florida

- Driver’s License: Obtain within 30 days of establishing residency.

- Voting: No specific time requirement; register at least 29 days before an election.

Nevada

- Driver’s License: Apply within 30 days of becoming a resident.

- Voting: Be a resident for 30 days before voting.

South Dakota

- Driver’s License: Obtain within 90 days of establishing residency.

- Voting: Be a resident for 15 days before registering to vote.

Tennessee

- Driver’s License: Obtain within 30 days of establishing residency.

- Voting: Be a resident for 30 days prior to the election.

Texas

- Driver’s License: Obtain within 90 days of establishing residency.

- Voting: Be a resident for 30 days before registering to vote.

Washington

- Driver’s License: Obtain within 30 days of becoming a resident.

- Voting: Be a resident for 30 days before registering to vote.

Wyoming

- Driver’s License: Obtain within 30 days of becoming a resident.

- Voting: Be a resident for 14 days before registering to vote.

Additional Steps to Establish Residency:

- Change your mailing address

- Update your bank accounts and credit cards with your new address

- Register your vehicle in the new state (if applicable)

- File taxes from your new state of residence

It’s crucial to consult with a professional familiar with digital nomad tax strategies to ensure you’re complying with all relevant laws and regulations. They can help you navigate the complexities of state residency laws and federal tax obligations for expatriates.

3. Open Travel Credit Cards and Bank Accounts

Managing your finances while abroad requires some preparation:

Apply for travel credit cards

Look for cards with no foreign transaction fees and travel rewards. Some of the best options for international travel include:

Chase Sapphire Reserve

- 3x points on travel and dining worldwide

- $300 annual travel credit

- Priority Pass Select membership for airport lounge access

- No foreign transaction fees

- Travel insurance benefits including trip cancellation/interruption insurance and primary auto rental coverage

American Express Platinum Card

- 5x points on flights booked directly with airlines or through Amex Travel

- $200 annual airline fee credit

- Access to Centurion Lounges, Priority Pass lounges, and Delta Sky Clubs (when flying Delta)

- Global Entry or TSA PreCheck application fee credit

- No foreign transaction fees

- Comprehensive travel insurance benefits

Capital One Venture X Rewards Credit Card

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

- $300 annual travel credit for bookings through Capital One Travel

- 10,000 bonus miles every account anniversary

- Priority Pass Select membership and access to Capital One Lounges

- No foreign transaction fees

Citi Strata Premier® Card

- 3x points on air travel, hotels, gas stations, restaurants, and supermarkets

- $100 annual hotel savings benefit

- No foreign transaction fees

- Travel insurance benefits including trip cancellation and interruption protection

Bank of America® Travel Rewards credit card

- 1.5 points per $1 spent on all purchases

- No annual fee

- No foreign transaction fees

- 0% intro APR on purchases for 15 billing cycles (then a variable APR applies)

- Points can be redeemed for statement credits to cover travel purchases

Consider U.S. bank accounts that make traveling easy

- Charles Schwab High Yield Investor Checking Account: Offers unlimited ATM fee rebates worldwide and no foreign transaction fees.

- Wise (formerly TransferWise) Multi-Currency Account: Allows you to hold and exchange multiple currencies.

- Revolut: Offers competitive exchange rates and a multi-currency account.

These options can help you avoid high fees and get better exchange rates while traveling internationally. Remember to notify your bank and credit card companies of your travel plans to prevent any issues with using your cards abroad.

4. Equip Yourself with Essential Tech and Equipment

Having the right gear is crucial for maintaining productivity on the road. Here’s what you’ll need and what to consider for each item:

Laptop and smartphone

- Laptop: Choose a lightweight, durable model with long battery life. Consider a 2-in-1 device for versatility.

- Smartphone: Opt for an unlocked model compatible with international SIM cards. Ensure it has a good camera for documenting your travels.

- Consider purchasing international warranties or insurance for both devices.

Portable Wi-Fi device

- Consider battery life and the number of devices it can connect simultaneously.

- Some popular options include GlocalMe 4G and SIMO Solis 5G.

- Without a battery, but including VPN are GL.iNet Slate AX

External hard drive or cloud storage solution

- External hard drive: Choose a rugged, portable model with sufficient capacity for your needs such as the Silicon Power 5TB or the ORICO 2TB SSD.

- Cloud storage: Consider services like Google Drive, Dropbox, or iCloud for easy access and automatic backups.

- Use both for redundancy and to ensure you never lose important files.

Noise-cancelling headphones

- Essential for maintaining focus in noisy environments and during travel.

- Look for comfort, battery life, and sound quality.

- If you want people to know you can’t hear them, consider over-ear headphones such as the Bose QuietComfort.

- If you’d like something more discrete and portable there are the Apple Airpod Pros or the Soundcore by Anker.

Power bank

- Choose a high-capacity model (at least 20,000mAh) to charge multiple devices.

- Look for fast-charging capabilities and multiple ports.

- Ensure it’s airline-approved for carry-on luggage.

- A good one with large capacity is this 38800mAh Portable Charger by RGVOTA

Universal power adapter

- Get an all-in-one adapter that works in multiple countries.

- Ensure it has surge protection to safeguard your devices.

- Look for models with multiple USB ports such as the mo4travel Universal Adapter or MOMAX Universal Travel Adapter that can also power your laptop.

Travel insurance

- Choose a policy that covers health, trip cancellation, and your tech gear.

- Consider long-term travel insurance policies designed for digital nomads.

- Look into options like World Nomads or SafetyWing that cater to long-term travelers.

Suitable backpack or luggage

- Backpack for men & for women: Look for comfort, durability, and features like laptop compartments and anti-theft designs.

- Luggage: Consider a carry-on size with spinner wheels for easy maneuverability.

VPN subscription for secure internet access

- Essential for protecting your data on public Wi-Fi networks.

- Look for services with a wide server network, strong encryption, and a no-logs policy.

- Once of the best options is NordVPN.

Additional items to consider:

- Portable laptop stand, one that I found to be durable and multi-purpose is this case stand by Nillkin.

- Compact, high-quality webcam for video calls

- Portable keyboard and mouse for extended work sessions

- Google Fi Service, an International SIM card, or an eSIM such as Saily with significantly better data pricing

Remember, while having the right gear is important, try to keep your setup as minimal as possible. Every item adds weight and takes up space, so choose multi-functional items when possible and only pack what you truly need.

5. Deal with Possessions Before Leaving

Before you embark on your journey, you’ll need to decide what to do with your belongings:

- Rent a storage unit: For items you want to keep but can’t take with you.

- Hire an estate sales company: To sell valuable items you no longer need.

- Donate items: Consider donating clothes, furniture, or other items to charity.

- Give away to friends and family: Offer items to people you know who might need or want them.

- Store at family’s house: If you have family members with extra space, ask if they can store some of your belongings.

Remember, the less you have to store or manage while you’re away, the more freedom you’ll have to focus on your travels and work.

6. Choose Your Travel Style

Before setting off, it’s crucial to decide on your travel style as a digital nomad. This will significantly impact your experience and planning:

Fast-paced travel

- Involves visiting multiple locations in a shorter time frame.

- Allows you to experience a variety of cultures and environments quickly.

- Requires more frequent relocation and adaptation to new workspaces.

- May be more challenging for maintaining a stable work routine.

Slow travel

- Involves staying in one location for an extended period (typically a few months or more).

- Allows for deeper immersion in local culture and lifestyle.

- Provides a more stable work environment and routine.

- Can be used as a regional base for shorter trips to nearby destinations.

Consider your work needs

- Fast-paced travel might suit project-based work with flexible deadlines.

- Slow travel could be better for roles requiring more stability or regular video calls.

Assess your personal preferences

- Do you thrive on constant change or prefer a more settled routine?

- How important is it for you to build local connections and fully experience a place?

- Involves visiting multiple locations in a shorter time frame.

- Allows you to experience a variety of cultures and environments quickly.

- Requires more frequent relocation and adaptation to new workspaces.

- May be more challenging for maintaining a stable work routine.

Remember, there’s no one-size-fits-all approach. Many digital nomads find a balance or adjust their style as they go along. The key is to choose a pace that allows you to both work effectively and enjoy your travel experiences.

7. Understand Tax Obligations

As a U.S. citizen, you’re still required to file taxes even when living abroad. Familiarize yourself with these important concepts:

U.S. Tax Savings Mechanisms

Foreign Earned Income Exemption (FEIE)

This allows you to exclude a certain amount of foreign earnings from your U.S. taxes. You can read more about it HERE, but the essential thing is to qualify you must pass either:

- Physical Presence Test: You must be physically present in a foreign country for at least 330 full days during a 12-month period.

- Bona Fide Residence Test: You must be a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

Other Considerations

- Foreign Tax Credit (FTC): This can help you avoid double taxation on income earned abroad.

- Double taxation treaties: These agreements between countries can prevent you from being taxed twice on the same income.

International Residency Programs for Tax Benefits

Several countries offer residency programs that can provide significant tax benefits for digital nomads:

- Paraguay Residency Program:

- One of the most accessible residency programs in South America.

- Requirements include a small bank deposit and proof of income.

- After 3 years, you can apply for citizenship.

- Paraguay has a territorial tax system, meaning you only pay taxes on income sourced within Paraguay.

- You can easily set up a residential address with a virtual mailbox service like Sweet Home Paraguay.

- Portugal Non-Habitual Resident (NHR) Program:

- Offers a flat 20% tax rate on certain types of income for 10 years.

- No tax on foreign-source income if certain conditions are met.

- Requires you to spend at least 183 days per year in Portugal.

- Panama Friendly Nations Visa:

- Relatively easy to obtain for citizens of specific countries.

- Panama has a territorial tax system, so you only pay taxes on income earned within Panama.

- After 5 years, you can apply for permanent residency.

Digital Nomad Visas with Tax Benefits

Many countries now offer specific visas for digital nomads, some of which come with tax benefits:

- Croatia Digital Nomad Visa:

- Allows you to stay for up to a year (renewable for another year after a 6-month break).

- Income earned from foreign sources is not taxed in Croatia.

- Requires proof of income (minimum of about $2,500 per month).

- Estonia Digital Nomad Visa:

- Allows you to stay for up to a year.

- You’re not considered a tax resident unless you stay for more than 183 days in a 12-month period.

- Requires proof of income (minimum of about $4,000 per month).

- Barbados Welcome Stamp:

- Allows you to stay for up to a year (renewable).

- No income tax is levied on foreign income.

- Requires an annual income of at least $50,000.

- Greece Digital Nomad Visa:

- Allows you to stay for up to a year (renewable for another year).

- Offers a 50% tax break on income for the first 7 years.

- Requires proof of income (minimum of about $3,500 per month).

Embark on Your Digital Nomad Journey with Confidence

By following these steps, you’ll be well-prepared to start your digital nomad adventure. Remember, proper planning is key to a successful and stress-free transition to this exciting lifestyle. Safe travels and happy working!

Leave a Reply